Wyckoffanalytics – Point-And-Figure Part I: Setting Price Targets Using Wyckoff Point-And-Figure Projections

$300.00 $29.97

Wyckoff Analytics – Point and Figure Part I

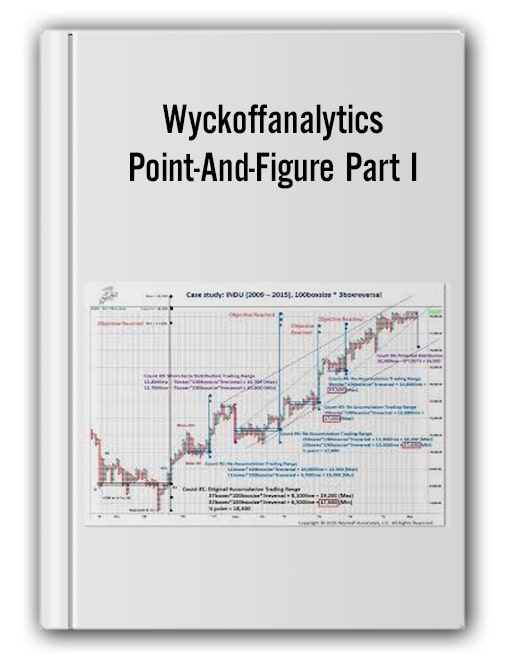

Wyckoff Analytics – Point and Figure Part I instructs the basis of Point and Figure technique developed by Richard Wyckoff. This method guided you to determine price targets and make better decisions of when to start trading and when to bail out through Point and Figure part I charts. It also smoothes the calculation of risk/reward ratio so that traders can maintain winnings. Wyckoff Analytics – Point and Figure Part I illustrates step by step how to take and project horizontal counts under the instructions of Bruce and Roman.

‘Cause and Effect’ underlies the Point and Figure method of Wyckoff. Part I of Wyckoff Analytics will explain the proper process of creating a Point and Figure (P&F) chart. Guidelines and applications applied to modern trading are pointed out. Subsequently, the analysis P&F Phase is indicated with the aim of short and long term price prediction. The timing of entries, as a result, can be determined easily.

In addition to part I we also provide separate parts II and III, please refer to the link below

Wyckoff Analytics - Point and Figure Part II

Wyckoff Analytics - Point and Figure Part III

Who is Richard Wyckoff?

Richard Demile Wyckoff (1873 -1934) was a prominent American stock market investor when pioneering the technical application to financial markets. He became so wealthy that he could own nine and a half acres and a mansion near the Hamptons estate in New York.

The more he was in the trading market, the more he witnessed the pitiful failures of other traders. Consequently, he shifted his concentration to education and research. In 1907, Wyckoff founded the Magazine of Wall Street which he dedicated to writing for about 20 years. In 1922, Richard Wyckoff published “Bucket Shops and How to Avoid Them”, which discloses the rules of the trading games.

Wyckoff continued to spend efforts on researching the core that profoundly impacted the market behavior, which makes his analysis aged well. He conducted many conversations and interviews with successful traders and investors at that time, including Jesse Livermore, J.P. Morgan, etc. Subsequently, he could point out the common characteristics among the best traders. Besides, the importance of risk management was also explained.

The Wyckoff technique might offer you the insight into why and how traders sell and buy to scale up their accounts. Moreover, the psychological and tactical aspects were mentioned as the edges of powerful players in the markets. Such timeless values that Wyckoff shared in his research inspired many traders today, including Bruce Fraser and Roman Bogomazov.

Who is Bruce Fraser?

Bruce Fraser has taught technical analysis, strategies and implementation, business cycle analysis and Wyckoff method for graduate-level courses at Golden Gate University since 1987. He has not only instructed Wyckoff but also applied the tactic to his own trading. He founded Wyckoff Market Discussion and has published popular blogs on Wyckoff methods with his friend, Roman Bogomazov.

Who is Roman Bogomazov?

Roman Bogomazov is the president of Wyckoff Analytics, LLC which provides online courses on Wyckoff Method. He has applied the insights of Wyckoff to his successful 20 – year trading career so that the curriculum he has developed on Wyckoff Analytics covers the basic and advanced levels of the technique combined with update status of market and trends.

Related Keywords:

Wyckoff Analytics pdf, WyckoffAnalytics, Wyckoff Analytics book, Wyckoff Analytics book pdf, Wyckoff Analytics methoh, Point and Figure Part I course download, Point and Figure Free

Be the first to review “Wyckoffanalytics – Point-And-Figure Part I: Setting Price Targets Using Wyckoff Point-And-Figure Projections” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading Courses

Forex Trading Courses

Forex Trading Courses

Forex Trading Courses

Reviews

There are no reviews yet.