Blog

VTI vs VTSAX: What are They and How do They Affect Your Trading ?

Introduction

Even though these two names are often seen going together, not too many people, even traders with prior knowledge can boast a complete and thorough understanding of VTI and VTSAX. In fact, people are commonly confused for each other due to their close similarities regarding underlying investment holdings.

However, VTI and VTSAX still have striking differences that we cannot use interchangeably. If you know how to utilize them in your investment portfolio fully, you will soon see their impact as well as the reasons behind their prominence and dependability. Let’s dive deeper into this article to know more about VTI and VTSAX.

VTI vs VTSAX: What are they?

What is VTI?

The Vanguard Total Stock Market ETF (also known as VTI) is an exchange-traded fund (ETF) established in 2001 and managed by Vanguard, acting as an exceptionally wide-ranging and market capitalization-weighted index for measuring the entire investible United States equity market.

So you may wonder what exactly are ETFs. They help pool the funds of many investors, which in turn get invested in stocks, bonds, and the like. ETFs are traded similarly to ordinary equities on the public stock market.

As one of the biggest ETFs owned by investors in the current stock market, VTI covers all three types of a company’s market capitalization out there, including large-cap, mid-cap, and small-cap companies.

Fund managers from VTI passively invest in stocks of companies from all market capitalization types aforementioned above, keeping VTI’s performance as close to that of the whole stock market conditions as possible. The number of stocks invested by VTI is up to 4,075 stocks of all kinds, with the top 10 sectors by allocation size as the following:

- Consumer discretionary

- Consumer staples

- Energy

- Financials

- Health care

- Industrials

- Technology

- Telecommunications

- Real estate

- Utilities

VTI usually acts as a passive index fund with a low turnover rate and an expected expense ratio as low as 0.03%. Putting that in perspective, it costs an investor $3 a year for every $10,000. This value is considered among the lowest in the market and should have little to no impact on your investment portfolio.

But still, it is not entirely risk-free. Like any other financial asset, VTI does carry the possibility of losses when certain events strike the stock market, such as a global economic downturn or unexpected major volatility, causing the value of VTI to decline.

What is VTSAX?

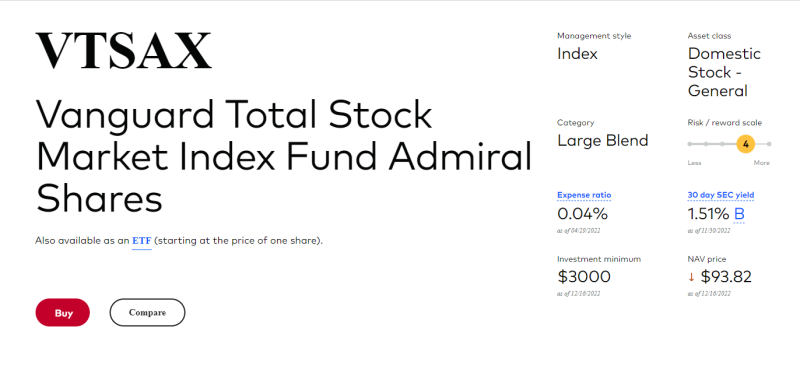

The Vanguard Total Stock Market Index Fund Admiral Shares (also known as VTSAX) – also established and managed by Vanguard way back in 1992 – is a broad-based mutual fund focused on the American market. The CRSP U.S. Total Market Index is also followed by VTSAX.

In general, VTSAX pools the funds from investors and uses them to purchase a wide range of assets and securities for investment. The fund is accountable for nearly 100% of the investable equity market in the United States, with highly steady returns over extended periods of time.

Similar to how VTI works as a passive index fund, VTSAX tracks the performance of the entire U.S. stock market and mimics its profitable movements instead of attempting to outperform it. The number of stocks held by VTSAX is more than 4,000 stocks with the 10 biggest names as the following:

- Apple

- Alphabet

- Amazon

- Berkshire Hathaway

- Exxon Mobil

- Johnson & Johnson

- Microsoft

- Meta

- Tesla

- UnitedHealth Group

Like the majority of Vanguard funds, VTSAX also seeks to maintain a minimal expense ratio. The expenditure ratio is an indicator of the management expenses that lower your returns. As of September 2022, VTSAX’s expense ratio was 0.04%, making it a cost-effective mutual fund to invest in.

Although the VTSAX does not have a lot of exposure to foreign stocks, a lot of the index’s constituent companies do have a sizable presence abroad.

For instance, large digital firms like Facebook, Apple, and Google conduct a sizable portion of their operations abroad and rely on these increasing profits for future expansion. Due to the fact that many American companies have sizable operations abroad, having a large investment in American companies nevertheless gives one some exposure to the global market.

Comparing VTI and VTSAX

The Similarities Between VTI and VTSAX

At first glance, we can easily see how the two always confuse people with no prior knowledge. They follow the same model working passively with funds and were both created by Vanguard. John “Jack” Bogle – the founder of Vanguard – believes that it is preferable to follow the stock market as opposed to trying to outperform it by picking particular securities.

Because of the ultimate aim they share, their similarities remarkably remain as below:

- The expected expense ratio is as low as 0.03%

- Competitively steady returns even in the long run

- Passive profits can be reinvested at your discretion.

- Excellent choices for investors who don’t want to choose a lot of different stocks

The Key Differences Between VTI and VTSAX

The primary distinction between VTI and VTSAX is that VTI is an ETF, whereas the former is an index fund. Below are the most striking three differences between them:

The minimum amount for investment: while it is significantly simpler to obtain VTI because you just need to have enough cash to purchase one share, which will cost approximately $204.45 as of September 10, 2022, you are required to spend as least $3,000 minimum initial commitment, you are eligible to invest in VTSAX.

In this case, VTI is much more friendly to newcomers as they can get their hands on VTI with a single share at a reasonable price.

Trading model: even though they share almost the same model that works passively with funds, their differences also take root from that of funds. VTSAX is a mutual fund with the most striking thing – it trades only once per trading day after the market closes.

On the other hand, VTI is an exchange-traded fund and gets traded multiple times during the day without waiting for the closing price. Day traders and the like who profit from short-time trading can take advantage of intraday price movements. VTI’s flexibility and quick profitability hold more favors from traders than VTSAX.

Dollar-cost averaging: a popular technique used by long-term investors involves investing a certain amount of money on a regular basis. Because you can purchase partial shares of a mutual fund, for instance, you could add $500 a month to the VTSAX mutual fund.

However, because ETFs typically trade in whole shares, it’s possible that you won’t be able to invest exactly $500 in the VTI ETF. At a price of $204.45 a share, you can purchase two shares for $408.90, leaving you with $91.10 in cash.

Although some of the top brokerage accounts permit fractional shares, you should be able to invest the whole $500 in VTI and receive approximately 2.56 shares.

VTI and VTSAX: What to Choose?

Providing that you now know the essential fundamentals of both VTI and VTSAX, you should have your eyes on one that may pose the most profitable to your investment portfolio. Both investments have excellent expense ratios and are well-managed.

Traders with prior experience in short-term and day trading may find VTI is the better option than VTSAX if they want to spend less than $3,000 in one of the two funds because VTSAX has a $3,000 minimum investment requirement as well as its significantly lower expense ratio.

However, if you don’t want to spend too much time on fractional shares, you might like VTSAX. No matter how many shares this amount can purchase, VTSAX enables you to keep your investment whole.

Conclusion

Both VTI and VTSAX are appealing options that may fit most portfolios thanks to their low expense ratios and nearly comparable investments. When choosing between the two funds, remember to take your own finances, investment goals, as well as your trading strategies, and styles into account for maximum profitability.