Simpler Trading – Phoenix Finder

Sale Page : simplertrading

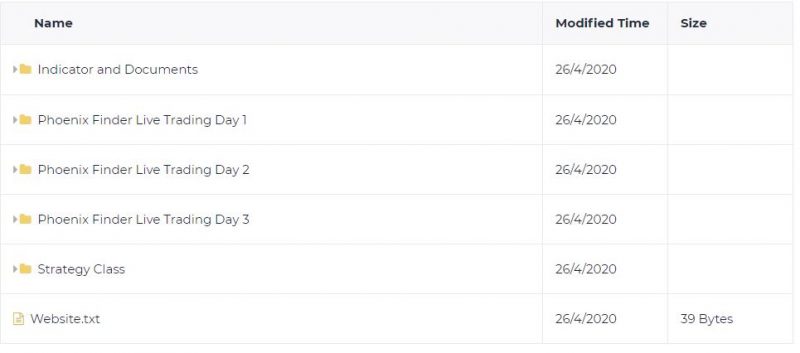

This product is available

Here’s the course you’ve been searching for to ignite your trading portfolio by revealing the profitable stocks in the hottest markets.

No matter what markets you’re in now.

Even if you have little trading experience.

Even if you don’t know what stocks or markets to consider.

This is the course that delivers the tools, tactics, and strategies to grow your trading account.

How does $1,000 profit in an hour sound?

That’s the power of the Phoenix Finder Tool and Strategy created by Danielle Shay, Director of Options and head of Simpler Foundation at Simpler Trading.

This trading system is designed to energize your trading plan whether you’re new to trading or a seasoned pro. It’s simple. It’s widely used by professionals and novices alike. And it has yielded 50%, 100%, even 200% gains.

How strong is the latest “hot” stock?

Which stocks are most advantageous to get into in any market … even a very volatile one?

How do I pick a profitable stock in a crazy market?

As the volatile markets throw ticker trackers into chaos, the Phoenix Finder rises above the mayhem to provide answers to critical stock selection and deliver strong picks for consistent gains.

There’s Even More To The Phoenix Finder Tool And

Strategy… Build Your Own Winning Trading Plan

With These Powerful Tactics:

“The Small Account and Net Liquidating Value” – Focus on the priority job required of traders to build a profitable small account. Boosting your equity curve is your trading purpose. Do you know your net liquidating value for your account? To avoid sucker punches from the market you need to have this number in sight with every trade.

“Reversion to the Mean and Market Movement” – Don’t get too fancy – pricing always reverts back to the mean. How do you know when this will happen? Learn to follow the market cycles daily and throughout the month. Don’t blow up your account by letting “winners run.”

“Small Lots, Average True Range, and DMI Indicator” – Eliminate decision-making noise and discover how “average” helps you build your small account with fewer, high-quality trades. This section of training can open up a whole new vision for how trend direction indicators guide you to take gains and repeat the process.

“Scanner Parameters, VWAP, and Volume Profile” – The technical side of trading can alert you to high-probability options to limit risk. Indicators help grow your small account with distinct points to buy or sell. Match this with insight into volume to plan trades “where the action is” from market-moving institutional traders.

Be the first to review “Simpler Trading – Phoenix Finder” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading Courses

Forex Trading Courses

Forex Trading Courses

Forex Trading Courses

Reviews

There are no reviews yet.