Quantumtradingeducation – Relational Analysis Module

$97.00 $10.97

Quantumtradingeducation – Relational Analysis Module

Sale page : quantumtradingeducation

This product is available

Relational Analysis

Every decision taken by every investor, trader or speculator, in every financial market everywhere in the world is about money. Nothing else – just money. Does this sound like an obvious statement? Perhaps , but it is also the single reason most forex traders struggle as they sit fixated on one currency chart wondering why the pair has moved against them.

Market prices are the result of the combined decision making by investors and speculators across all markets withtwo objectives in mind. Either to increase their wealth or to protect what they have.

When a market participant buysa high risk asset class, they are relinquishing liquidity in return for some future gain, and prepared to take on higherrisk. On the other hand, when a market participant sells a high risk asset class, they are looking for a safe haven toprotect their gain, and will consequently buy a low risk asset class as a result. However, once risk appetite returns,then high risk assets will be bought again.

This is the cyclical process that all markets follow minute by minute and day by day, as money flows from high risk to low risk assets and back again, all driven with one thing in mind. To maximise potential returns on that money.

Every asset class in every one of the financial markets has a different risk profile and as a result, market sentiment and risk appetite ebb and flow continually. It is this constant flow of money which drives the markets.Understand the money flow, and you begin to understand market behaviour in all its forms.

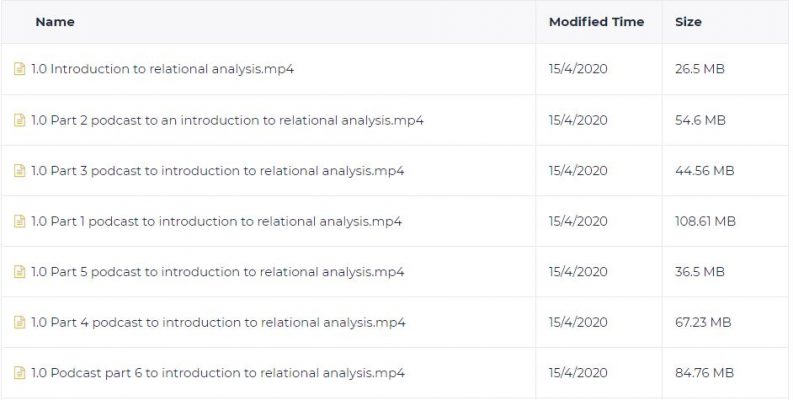

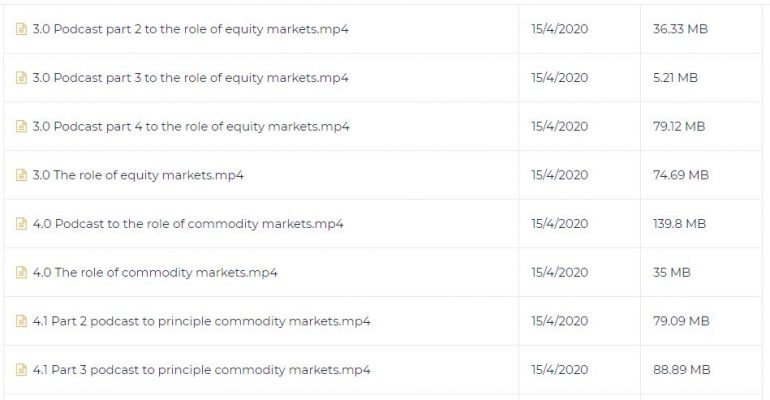

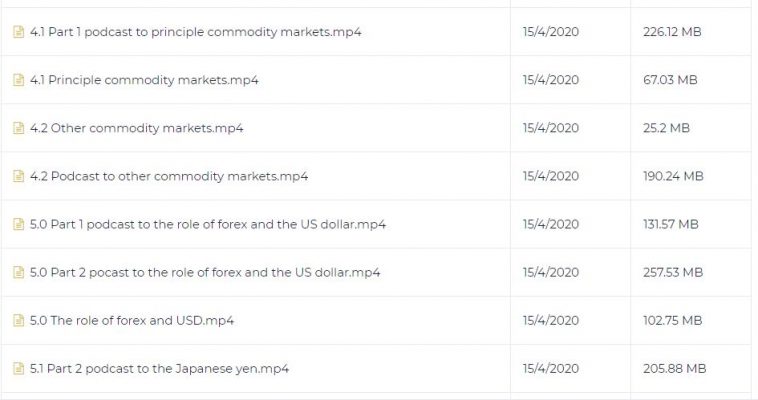

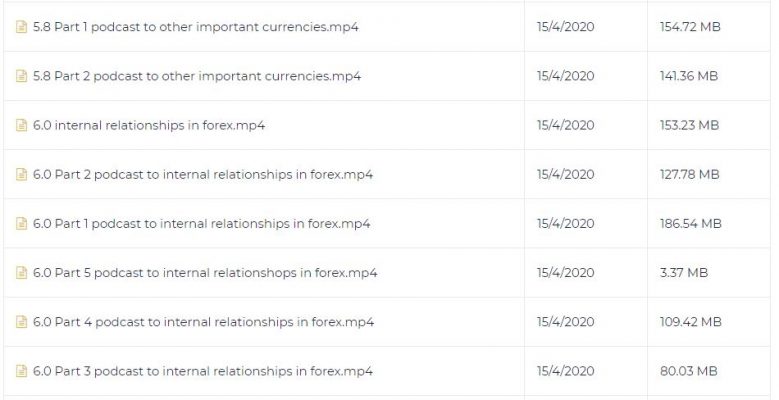

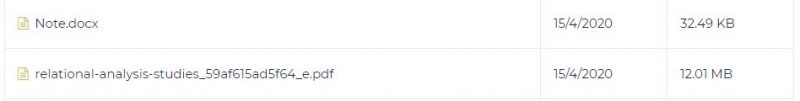

The module includes seventeen videos, seventeen video podcasts and one ebook.

The book contains over 80 worked examples of the relational aspects of market behaviour in action, annotated and explained with a detailed commentary. Finally the book also covers one of the trickier aspects in helping you to understand yield curves, and interpreting the COT report and what it reveals.

By the end of the module, you will understand precisely how the four capital markets work and the relationships that exist between them. These are the relationships which ultimately drive money flow in the constant search for higher or lower risk.

These flows are constant and unrelenting and occur in all timeframes as risk on and risk off appetite drives demand, and at the centre of it all lies the forex market, which is the king pin around which the others rotate.In understanding these relationships you will then be in a position to take advantage, applying this knowledge to the currencies and currency pairs as risk sentiment ebbs and flows throughout the trading day.

Be the first to review “Quantumtradingeducation – Relational Analysis Module” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading Courses

Forex Trading Courses

Reviews

There are no reviews yet.