Peter Worden – Video Series Course

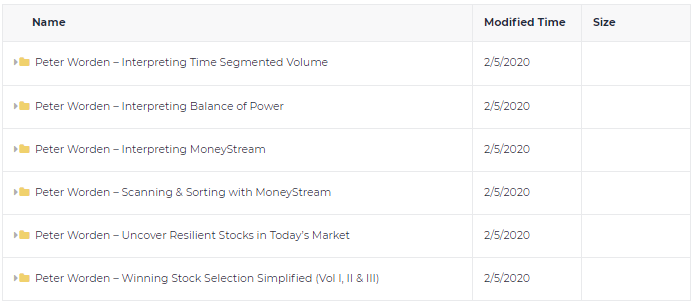

Peter Worden – Interpreting MoneyStream

What You’ll Learn:

- What MoneyStream is trying to tell you

- How to spot both positive and negative divergences between price and MoneyStream

- How to identify ideal price and MoneyStream chart setups for both bullish and bearish trades

- Best practices in using historical charts to learn and practice a new method of indicator interpretation

Peter Worden – Interpreting Balance of Power

Peter Worden, co-founder of Worden Brothers, teaches live at an award-winning TC2000 training class in Tampa FL. He delves into the interpretation techniques for Worden proprietary technical indicators Time Segmented Volume, MoneyStream and Balance of Power created by his father, Don Worden. Peter demonstrates how to use these indicators to establish the primary bias of a stock by ferreting out what the ‘smart money’ is currently doing. By walking through the indicator development in chart setups of actual stocks Peter helps you learn the basic principles for practical application of these exclusive TC2000.com indicators on the stocks you follow and trade.

What You’ll Learn:

- What each of the proprietary indicators are telling you about price movement

- How large block trading impacts the flow of stocks

- The role of divergence in understanding these indicators

- What constitutes bullish or bearish behavior

- How important are moving averages in relation to these indicators

- Examining the quality of buying or selling in price moves

Peter Worden – Scanning & Sorting with MoneyStream

What You’ll Learn:

- How to analyze MoneyStream-related tabular data to find charts of interest

- How to use EasyScan to create narrow watchlists of both bull and bear trade candidates based on MoneyStream behavior

- Implement Peter’s MoneyStream analytics to find the best possible MoneyStream chart patterns in the market

Peter Worden – Interpreting Time Segmented Volume

What You’ll Learn:

- How to incorporate Time Segmented Volume into your charting routine

- What TSV is telling you and how to spot confirming and divergent behavior between TSV and Price

- Which settings for TSV may be most appropriate given your trading style

- How to identify ideal TSV patterns for both bullish and bearish trading opportunities

- What multiple timeframe analysis does to enhance the way you trade

Be the first to review “Peter Worden – Video Series” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading Courses

Forex Trading Courses

Forex Trading Courses

Reviews

There are no reviews yet.