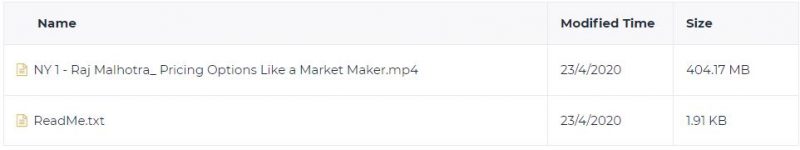

NY 1 – Raj Malhotra – Pricing Options Like a Market Maker

$25.97

NY 1 – Raj Malhotra – Pricing Options Like a Market Maker

Sale Page: itpm

This product is available

Video length: 43 Minutes

Firstly they need to know if the Options prices and therefore the price of Volatility are a fair and accurate reflection of reality. By knowing this, they are less likely to get “ripped off” by an Options Market Maker. Secondly, understanding how Options Market Makers operate and price Volatility and Options helps investors and traders get an edge over the Market Markers (Brokerage Platforms) by realising when mispricings of Options occur so they can take advantage of them.

As an Options Trader, Raj Malhotra has had one of the most successful careers on Wall Street in recent history.

In this Seminar, Raj helps Retail Traders to understand both the motivations ozf Options Market Makers and why and how they price Volatility and Options in the way they do. Understanding this is of crucial importance to any investor or trader. This is because when looking to express Trade Ideas or Positions using Options.

80% of Retail Traders lose money on these platforms because they do not understand how to Price Options Like a Market Maker. Until NOW!

What is Trading?

Everybody is familiar with the term “trading”. Most of us have traded in our everyday life, although we may not even know that we have done so. Essentially, everything you buy in a store is trading money for the goods you want.

At tradimo you will learn how to trade the financial markets online – but exactly what is online trading? This article will give you an understanding of how trading can be defined and how online trading works.

Be the first to review “NY 1 – Raj Malhotra – Pricing Options Like a Market Maker” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading Courses

Forex Trading Courses

Nathan Michaud – Tandem Trader – The Ultimate Day Trading Course

Forex Trading Courses

Lockeinyoursuccess – The Super Simple Spread Trades by John Locke

Reviews

There are no reviews yet.