Author: LTG Trading

Trading is a business and it must be treated as such. They have a strategy in place and the only time they deviate from that strategy is when it is planned out ahead of time. Adjustments are made when economic conditions change, when trying new ways to increase profits, or if part of the plan isn’t working.

Richard D. Wyckoff was a successful stock trader from the early 1900’s and developed a “business plan” of his own. Through conversations, interviews and research of the successful traders of his time, Wyckoff augmented and documented the methodology he traded and taught.

Wyckoff worked with and studied Jessie Livermore, E. H. Harriman, James R. Keene, Otto Kahn, J. P. Morgan, W. D. Gann, and many other large operators of the day. His thought was that you must develop the ability to translate price action, and the volume that drives that action, into trading opportunities. The chart below is an example of his observations about what happens to markets.

Wyckoff Starter

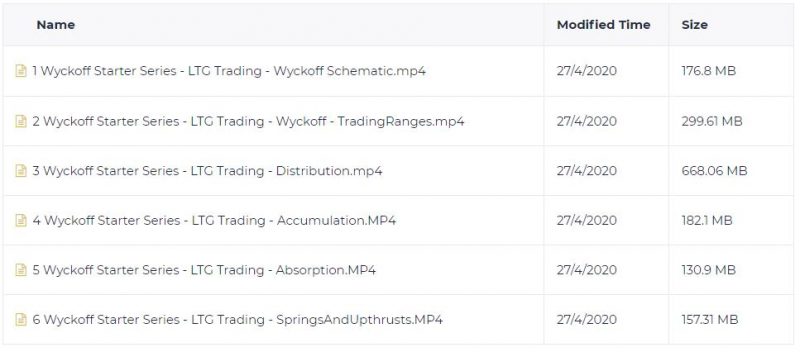

For anyone who wants to learn the basics of Wyckoff principles, this series is for you. It’s also a great refresher course! This series of six webinars is hosted by Gary Fullett. Each recording is approximately one hour long, and covers the following topics:

- Wyckoff Schematic

- Trading Ranges

- Distribution

- Accumulation

- Absorption

- Springs and Upthrusts

Be the first to review “LTG Trading – Wyckoff Starter Series” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading Courses

Adam Khoo – Value Momentum Investing Course – Whale Investor

Forex Trading Courses

Forex Trading Courses

Forex Trading Courses

Forex Trading Courses

Reviews

There are no reviews yet.