Blog

Lean FIRE Calculator: The Way to Financial Freedom for Middle Class

You may be closer than you realize to being able to retire early and do what you want with your life. Lean FIRE Calculator , a version of the Financial Independence, Retire Early (FIRE) movement, will be a huge solution for the common individual who wants to become work-optional and is ready to dramatically reduce unnecessary costs.

What is Lean FIRE?

Lean FIRE (Financial Independence, Retire Early) is a strategy that aims to retire early, often before the age of 60 or older, while living a very frugal and simple lifestyle.

To consider Lean FIRE, your assets must simply support your most fundamental living expenses. No extra money is available for frills. In addition, it’s challenging to have kids and live in a big city while doing Lean FIRE.

Those pursuing Lean FIRE typically need to maintain an active revenue stream in retirement. Consulting, part-time work, internet sales, blogging, freelancing, and other creative endeavors all qualify as examples of active revenue streams.

How to calculate your Lean FIRE number?

If you want to calculate your Lean FIRE number, you must first know the annual retirement spending you envision. That sum would cover little more than essentials like food, shelter, and transportation, plus a minimal amount for fun.

To achieve Lean FIRE, luxury is not a priority. Establishing your annual spending is a good place to start. Similar to standard FIRE, the formula for determining your Lean FIRE number is as follows:

Lean FIRE Number = 25 x (Annual Living Expense)

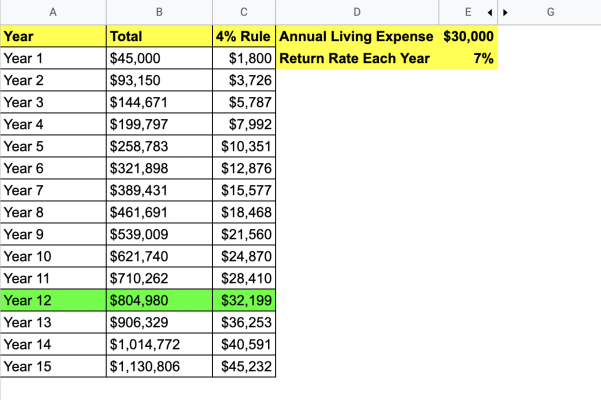

For example, your annual living expense in retirement would be $30,000 per year, and your current savings is $40,000 each year, with a return rate of 7%/year.

Then, your Lean FIRE number = 25 x 30,000 = $750,000.

And here is how you achieve this number :

So, if you save $40,000 a year, it will take you about 12 years to reach Lean FIRE.

Sample of a potential Lean FIRE budget

Given that a spending model for a more Lean FIRE strategy would include allocating 50% more of the median household income, the goal Lean FIRE budget would involve allocating 50% less. So, $34,352 per year is the goal of passive income.

To withdraw at a rate of 3.5% (with a multiplier of 28.6), you would need to have saved $982,453. While certainly not a small amount, it pales in comparison to the $3 million required in the fat FIRE scenario.

The monthly cost of $34,352 would be $2,863. If you can house hack your way out of paying for a home, your $2,863 monthly budget will look like a lot more of a workable number.

And in many nations, a monthly budget of $2,863 will allow you to live in the lap of luxury. In a number of European countries, such as the Netherlands and Sweden, $2,000 monthly will provide a comfortable standard of living.

It doesn’t take long to retire comfortably if you make a good living and limit your spending to the Lean FIRE guidelines.

How to achieve Lean FIRE? The step-by-step guide to your financial freedom

Optimize cost on living space

Whether or if you can achieve Lean FIRE depends on where you live and how you live. Learn more about the states and localities that have a low cost of living and are a good fit for your way of life.

One option is to downsize one’s home or to forgo paying a mortgage altogether by moving into a van and living rent-free. Traveling on a budget is possible even with a Lean FIRE lifestyle when you live in a van and do remote work.

Always create passive income sources

Make use of your skills and experience to generate passive income streams to complement your present income and ensure your financial security in the future. Making money online can take many forms, such as creating and monetizing a blog, renting out a room in your home, launching a YouTube channel, selling used books, and so on.

Become a budget master

Whenever possible, wait at least 30 days before making a purchase. Because of this, you’ll be able to control your spending patterns and set yourself up for long-term financial success with Lean FIRE.

This is where your budgeting prowess really shines, though. Keeping to your financial plan, conducting thorough analysis, and keeping your eye on the numbers will be crucial to your success.

Be more aggressive in investing

Get the help of a financial planner or do some independent investigation to determine which tax-favored investment accounts would yield the most return. There’s nothing worse than seeing your hard-earned money erode in value due to inflation, so one of the first things you should do is put your savings into an account that earns a high interest rate.

Who is Lean FIRE suitable for?

Before deciding if Lean FIRE is the best option for you, there is a lot to think about. You may be a good fit for Lean FIRE if the idea of cutting your expenses to the bone and retiring early appeals to you.

In addition, if you have no qualms about relocating to a cheaper state or even another nation, Lean FIRE could be the perfect plan for you.

It’s not for everyone, but if you want to retire early, ditch the W-2 and 9-to-5, and live comfortably on much less money than you would with Fat FIRE, for example, it could be a terrific option.

Pros and cons of Lean FIRE

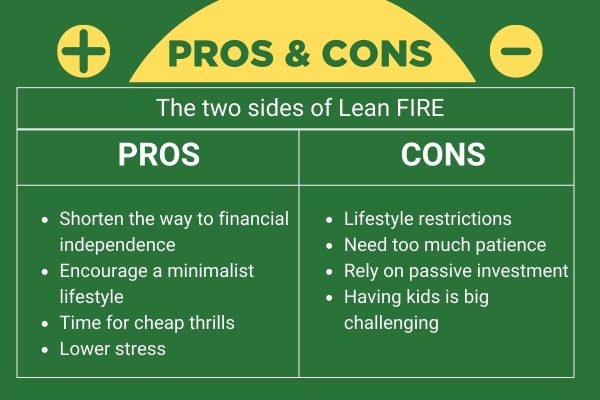

What are the benefits of Lean FIRE?

1. Reach financial independence and early retirement easier and quicker

One of the quickest ways to retire comfortably is the Lean FIRE method. Lean FIRE has been shown to allow for early retirement for the rest of one’s life, provided one can handle the necessary lifestyle changes and regularly save and invest. It will ensure your financial well-being in the event you are unable to work.

2. Encourage a spartan way of life

If you’re trying to save money, adopting a more frugal lifestyle may mean taking the bus more often or eating less meat. On the other hand, the influence you have on the planet will be lessened thanks to your decisions. The Lean FIRE philosophy is a good fit for those who seek to live a simple life with little concern for possessions.

3. Discovering low-cost thrills

When you adopt the principles of Lean FIRE, you start thinking about novel ways to spend your time. You may spend your weekends at a nearby lake camping and fishing rather than going to the movies or bowling.

Lean FIRE suggests that we should look for enjoyable activities that won’t break the bank. This could be the first step in discovering a brand new interest or even a new career path for you!

4. Stress reduction

The goal of the Lean FIRE movement is to help people feel less anxious and stressed about their finances by helping them create and stick to a clear financial plan.

Money worries put a lot of stress on many people’s thoughts, which can have a negative effect on their bodies as well. Feelings like these may dissipate if you take a direct approach with the Lean FIRE lifestyle and see positive results quickly.

Does Lean FIRE have any disadvantages?

Limit your lifestyle

Those who are trying to save money will inevitably have to make sacrifices. However, the expectations of Lean FIRE mean that you’ll need to make even more drastic cuts to your spending—by more than 20%.

Patience is a necessity

Planning ahead, and for many of us, time, is essential to achieving Lean FIRE. In all likelihood, if you’re considering retiring early, you’re not yet financially secure.

That’s cool, but be aware that becoming a part of this movement demands not only doing your homework, but also regularly making sound financial choices. If you want to make this a long-term way of life, you need to be ready mentally before you embark on your adventure.

Dependence on passive investment

When the coronavirus outbreak hit in 2020, the stock market promptly plummeted by 40%. Those who achieved their dreams of financial freedom faced a sudden and severe reduction in their resources.

Those whose retirement savings are contingent on dividends and investment returns will feel the effects of this temporary setback. Just picture a prolonged economic downturn or stock market decline.

Family is a big obstacle

Having kids can be a hindrance to your Lean FIRE goals. This increases your outlays, making it more challenging to maintain a tight budget.

Spending $233,610 for a child from birth to age 17 is the national average. However, that doesn’t imply having kids will prevent you from living frugally in the long run; it just means it’ll need more planning and sacrifice.

Lean FIRE can be a realistic path to early and secure retirement if you are childless or do not expect to have children.

Compare Lean FIRE with different types of FIRE

Lean FIRE vs. Traditional FIRE

The term Lean FIRE describes the concept perfectly: it’s a more streamlined version of the standard FIRE protocol. By comparing their current level of living to that which they enjoyed before retirement, adherents of the Financial Independence, Retire Early philosophy can confidently plan for a retirement income that keeps pace with inflation.

Lean FIRE vs. Fat FIRE

You can think of Fat FIRE as the antithesis of Lean FIRE. In this iteration of the FIRE movement, members aren’t interested in cutting costs wherever possible. Instead, they want to take advantage of every opportunity presented to them and savor every moment of their lives.

Lean FIRE vs. Barista FIRE

Barista FIRE (link tới bài Barista chị viết) does not include the retirement component of FIRE but still allows individuals greater freedom and personal fulfillment. Fans of the FIRE movement who work as baristas, for example, may be financially independent on paper but keep their day jobs for the security of benefits like health insurance or residual income.

Lean FIRE vs. Coast FIRE

The idea behind Coast FIRE is to save as much as possible for retirement in your early years of work. Once you’ve put in the groundwork, you may sit back and let your savings grow over time until they reach your FIRE figure. The appeal of Coast FIRE is that it allows you to stop making retirement fund contributions and instead put that money toward other goals, giving you the confidence that you’re ahead of schedule for retirement.

Wrap it up

There are some people who aren’t cut out for the Lean FIRE lifestyle, but if you’re itching to get out of the rat race, this is one of the easiest ways to achieve it. Learn your numbers, start taking action or making more money to get yourself back on track, and start piling up cash to kickstart your journey toward reaching your goal of becoming financially independent.