Blog

What Are the Best Time Frames to Trade Forex on the Market?

Forex markets are largely open 24 hours a day, seven days a week. That opens the door to the idea of forex trading around the clock. But most traders will find that a serious problem: As soon as you start trading on the market at 5 PM, it doesn’t stop until 5 AM the next morning. So how long can you stay awake? In order to figure out how long you can trade on the market and make profits with your chosen timeframe, we need to take a close look at which markets are open and when they are open.

This is a list of the best time frames to trade Forex on the market. It’s important not just in terms of success rates but also when to invest your time. Let’s get started!

How to Determine the Best Time Frame to Trade Forex?

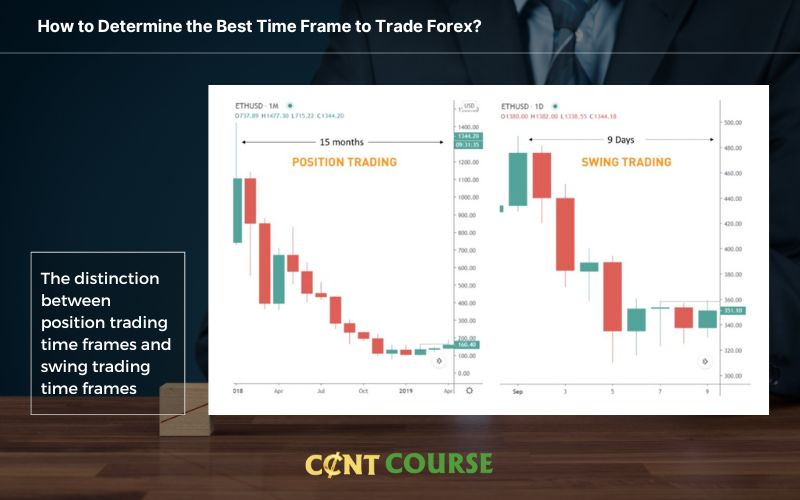

The optimal time frame for forex trading will differ based on the trading technique you choose to achieve your individual goals and where you trade. Traders employ several tactics, which influence the time frame employed. A day trader, for example, will hold deals for a much shorter length of time than a swing trader. For a general introduction to different trading styles, see our tutorial.

Position trading time frames

The time range for trading positions varies depending on the trading strategy, as shown in the table above. Under the ‘long-term’ concept, this might range from daily to yearly.

Many beginner traders shun this strategy since it implies extended periods of time between deals. However, many traders believe that trading in the short term (day trading) is substantially more difficult to execute well, and it frequently takes traders much longer to build their technique.

Longer-term position trading strategies might look to the monthly chart for grading trends and the weekly chart for prospective entry chances.

Swing trading time frames

After gaining confidence in the longer-term chart, a trader might try to shorten their strategy and desired to hold durations. This can inject more unpredictability into the trader’s strategy, thus risk and money management should be addressed before shifting down to lower time periods.

Swing trading is a good compromise between a long-term trading time frame and a short-term best time frame for scalping strategy. One of the biggest advantages of swing trading is that traders may get the benefits of both methods without incurring all of the drawbacks. As a result, swing trading has become a very popular market strategy.

Swing traders will check the charts several times every day to see if there are any large swings in the market. This gives traders the advantage of not needing to constantly monitor markets while trading. Once an opportunity is discovered, traders enter the trade with a stop loss and watch the deal’s development later.

Day trading time frames

One of the most challenging ways for achieving success is day trading. Newer traders who use a day trading strategy are exposing themselves to more frequent trading decisions that they may not have made for a long time. This mix of expertise and frequency exposes the trader to losses that may have been avoided had the trader chosen a somewhat lengthier technique, such as swing trading.

The scalper or day trader is in the unpleasant situation of needing the price to move swiftly in the trade’s way. As a result, the day trader gets inextricably linked to the charts as they seek the market’s patterns for that day. Long durations of obsessing over charts might lead to tiredness. The shorter-term strategy also allows for a lower margin of error.

The Forex Markets’ Operating Hours

New York

According to “Day Trading the Currency Markets” (2006) by Kathy Lien, New York New York (open 8 a.m. to 5 p.m.) is the world’s second-largest FX platform, closely monitored by international investors since the U.S. dollar is engaged in 90% of all deals.

The New York Stock Exchange’s (NYSE) movements may have an immediate and dramatic impact on the dollar. When corporations combine and acquisitions are completed, the dollar can quickly gain or lose value.

Tokyo

Tokyo, Japan (open 7 p.m. to 4 a.m.) was the first Asian trading hub to open and now accounts for the majority of Asian trade, trailing only Hong Kong and Singapore. USD/JPY (or US dollar vs. Japanese yen), GBP/USD (British pound vs. US dollar), and GBP/JPY are currency pairings that see a lot of activity (British pound vs. Japanese yen). Because of the Bank of Japan’s (Japan’s central bank’s) significant influence over the market, the USD/JPY is an especially useful pair to observe when the Tokyo market is the only one open.

Sydney

The trading day officially begins in Sydney, Australia (open from 5 pm to 2 am). While it is the smallest of the mega-markets, it sees a lot of early movement when the markets reopen on Sunday afternoon because individual traders and financial institutions are seeking to reorganize following the extended halt that began on Friday afternoon.

London

The United Kingdom (U.K.) leads global currency markets, with London as its focal point. According to a BIS analysis, London, the world’s principal trading hub, accounts for around 43% of global trade. The city also has a significant influence on currency swings since the Bank of England, which sets interest rates and regulates the GBP’s monetary policy, has its headquarters in London. Forex trends frequently start in London, which is important for technical traders to remember. Technical trading is analyzing statistical patterns, momentum, and price movement to locate opportunities.

So, What Are the Best Time Frames to Trade Forex on the Market?

Currency trading is distinct due to its operating hours. The week begins on Sunday at 5 p.m. EST and ends on Friday at 5 p.m.

Not all hours of the day are suitable for trading. When the market is most active, this is the greatest moment to trade. When more than one of the four markets is active at the same time, the trading environment is heightened, resulting in more volatility in currency pairings.

How to Choose the Best Time Frames to Trade Forex on the Market?

There are two main methods for determining a timeline on your own: the trial-and-error technique and the personality test method.

Trial-and-error

This way is pretty easy: just try out different time frames until one feels right to you. If that doesn’t work, then try again with another timeframe. It involves asking yourself some questions while trading:

- Do you believe the market is moving too quickly or too slowly? Assume you wish to trade the EURUSD. Do you see the market price barreling through where you’d want to enter the trade before you finish your analysis? Is it an eternity until it reaches your profit? These might be indicators that your trading time frame is too quick or too sluggish.

- Do you always have time to check in on your deals before they close? Consider trading on a smaller period if you discover that you have more time than you need to examine your deals before they close. In addition, if you see that your deals are closing before you can watch them, consider trading on a greater timeframe.

Personality check method

Consider your personality and ask yourself the following questions before deciding on a timeframe:

- How tolerant are you? Higher time frames (daily, weekly, or monthly) are your friends if you have the patience to hold a transaction for days or even weeks.

- Do you wish to enter and exit transactions in a single day? Because if you do, you have the option of working with shorter deadlines. In this manner, you may do your analysis, initiate trades, and close them before the end of the day. Then you should select the 15-minute, 1-hour, or 4-hour durations.

- Do you have a limited amount of time to trade? With little time to spend on the Forex market, you want to get in and out of deals in minutes. Trade on very short periods ranging from one minute to fifteen minutes.

- How frequently do you prefer to keep an eye on your trades? Low periods are ideal if you wish to review your transactions often. Choose anything from the 15-minute to the 4-hour timeframe.

- How would you describe your trading style? Swing, intraday, position, and scalp trading are the most frequent trading techniques. Each trading technique has a timing guideline shown below.

In Conclusion

So, what is the optimal timing for Forex trading? There isn’t, unfortunately. Asking for the optimal trading timeframe is like asking for the ideal shoe size. Because the size of your shoes is determined by the size of your feet. Some traders analyze their trades using different timeframes. You simply need to put in the effort to figure out what works best for you.